indiana real estate tax lookup

Find information about filing Personal Property Forms. Business Personal Property Taxes.

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Public Property Records provide information on land homes and commercial properties including.

. Why havent I received my tax bill. Real and personal property tax records are kept by the County Assessor in each Indiana County. Easily Find Property Tax Records Online.

You can find this number on your tax bill. What records are available to the public and what records are confidential. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6.

It may not reflect the most. Property data is routinely updated usually daily from each jurisdictions source data systems. Enter the duplicate number found on your tax bill.

124 Main rather than 124 Main Street or Doe rather than John. Ad See Anyones Public Records All States. After connecting to the Beacon portal begin by selecting Indiana and then Johnson County from the drop down menus.

Expert Results for Free. Accepted Forms of Payment. Comparables Search Perform advanced searching of properties within each jurisdiction based.

Typically tax payments are due May 10th and November 10th of each year. About Assessor and Property Tax Records in Indiana. All information on this site has been derived from public records that are constantly undergoing change and is not warranted for content or accuracy.

Change Tax Bill Mailing Address. Search by address Search by parcel number For best search results enter a partial street name and partial owner name ie. Land and land improvements are.

Just Enter Your Zip for Free Instant Results. Ad Just Enter your Zip Code for Property Tax Records in your Area. Select Property Search to accept Terms.

How much property tax do I owe. Property Report Card Loading. Enter the Tax ID Number as numbers only.

Searching for a property. Property Report Card. Use our free Indiana property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and.

Ad See Anyones Property Record History. Type Any Name Search Now. Property tax statements will be mailed by mid-April each year.

Search for your property to find its assessed valuation. Type Any Name Search Now. What criteria must I meet to qualify for your.

A Indiana Property Records Search locates real estate documents related to property in IN. CreditDebit Cards are now accepted in the Treasurers Office 25 fee by phone 1-877-690-3729 25 fee and through the Internet at wwwsteubeninus or FORTE.

Tax Assessment Indiana County Pennsylvania

Indiana Property Tax Calculator Smartasset

If You Know Someone That S Looking For A New Home Tag Them This Could Be The One They Re Looking For Keepingitre Indiana Real Estate Real Estate New Homes

Indiana Property Tax Calculator Smartasset

Indiana Property Tax Calculator Smartasset

Real Property Management In Northwest Indiana Rental Home Management

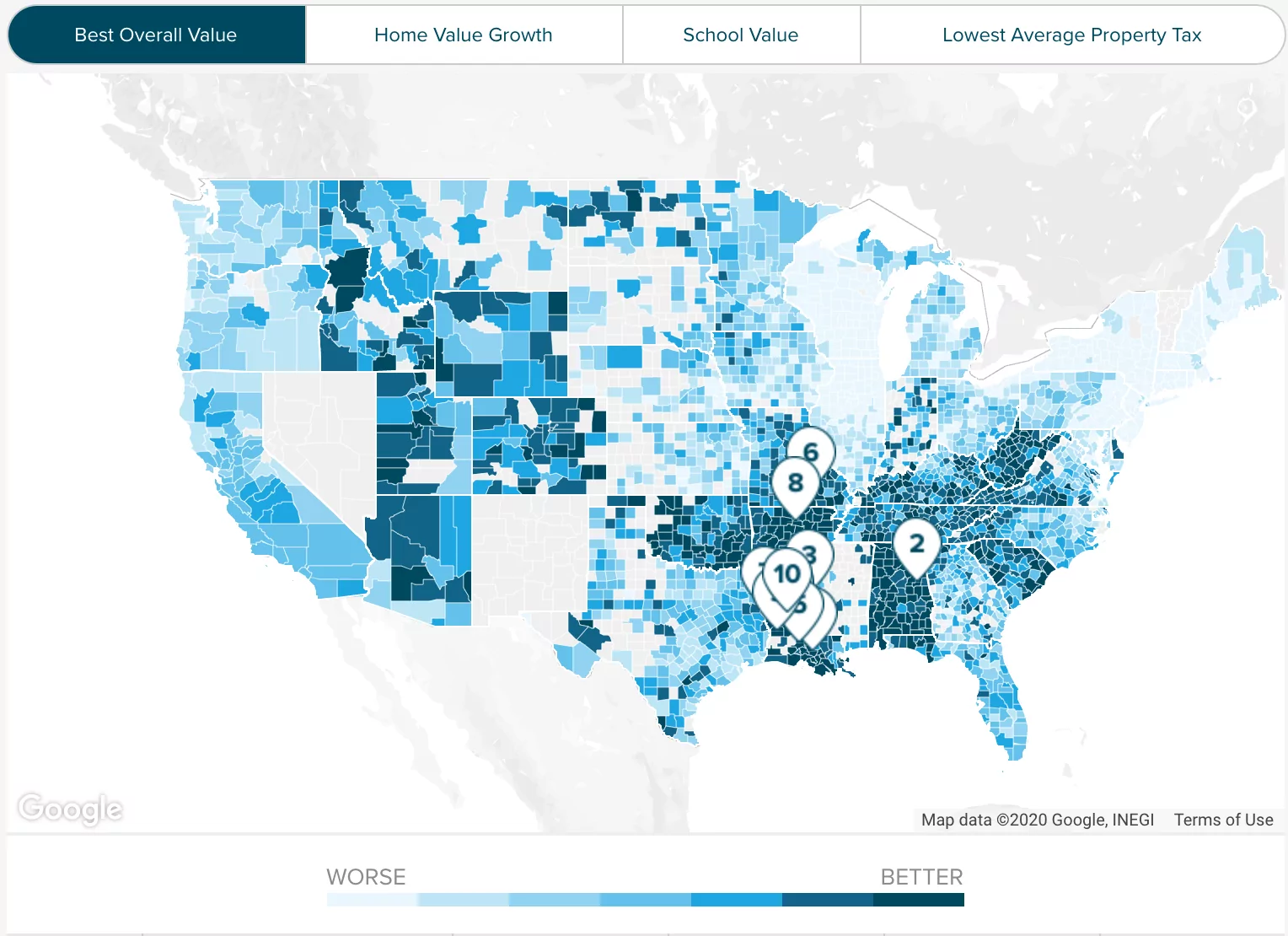

Who Pays The Highest Property Taxes Property Tax Denver Real Estate Real Estate Tips

Database Luzerne County Real Estate Citizensvoice Com

Cook County Il Property Tax Calculator Smartasset

Deducting Property Taxes H R Block

Access Property Tax Assessment Records Tippecanoe County In

Dlgf Citizen S Guide To Property Tax

Assessor S Office Sullivan County In

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth